Standard Amount for Earnest Money when Buying Property in Park City?

Posted by Sean Matyja on Monday, April 22nd, 2013 at 7:42am.

How Much Earnest Money is Required when Buying Property?

Earnest Money is the initial deposit that a buyer will submit when writing an offer on a property that is listed for sale. While there is no real "standard" amount of earnest money required, the amount submitted with an offer can have a strong affect on the offer's strength. In Park City Utah, it is typical to see the earnest money at about 1-2% of the purchase price for the property. We do however see buyers offer less, and we also see some buyers offer more. Typically a cash buyer will offer a higher amount of earnest money to show their strength and ability to purchase, while buyers planning to obtain a mortgage will offer a little less. There is no real right or wrong, or standard amount, however as local Park City Realtors we do have our opinions when representing a buyer or seller.

What brings up this topic is that we recently "offended" a buyer for one of our listed properties in Park City. We represent the seller of a condo in the Three Kings townhomes in Park City's Old Town neighborhood. After numerous showings we finally did receive an offer from a Salt Lake City resident, who is working with a Realtor from Salt Lake City. We had the condo listed at $399,000 and had just lowered the property to $389,000. We felt like we were priced very well, and only lowered to bump up interest as it was nearing the end of the busy ski season.

The offer came in at $370,000 with financing needed, and the earnest money was only at $2,000. Now this was viewed by the seller as a decent initial offer, however it was not enough to get a deal done so we countered, which is very normal. In Park City it is typical to see the earnest money between 1-2%, and all depends on the willingness and commitment of the buyer. We countered the offer at a price of $379,500 meeting them halfway. On the earnest money we asked for $7,500 which was just a hair under 2%, and we even stated they could have 4 weeks for loan denial deadline vs. the 3 they asked for (because we knew how difficult resort town financing can be).

In Park City, Earnest Money is typically 1-2%

The buyer was apparently offended that we asked for more earnest money. They viewed it as us as being "conceited" Park City agents and a personal offense to their financial ability. Now I had already explained to their agent that 1 - financing in Park City was a different process and difficult because so many of our condo associations are largely owned by investors and have a much larger mix of investment properties and nightly rentals, and not the common primary resident owners. And 2 - that in Park City we typically see 1-2% for earnest money. We wanted a larger deposit of earnest money so the buyer and their agent would take the loan approval process more seriously. To be clear, we were not worried about the buyers ability to close, but we were worried about the condo HOA's ability to be approved by a loan underwriter.

I'm now getting a bit off topic, but regardless, the 2% request of earnest money is normal here and I explained that to the buyers agent. He failed to explain to his client that we were making a normal request in the Park City market, even though they do not do so down in the Salt Lake Valley market - another reason to work with a LOCAL realtor - again off topic and I could go on for hours about that too!

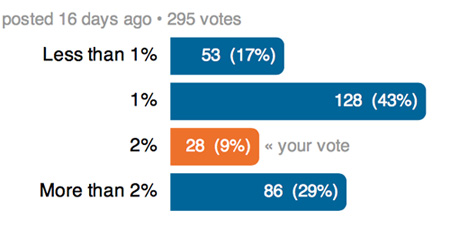

So with the rejection we received, and the "hurt feelings" we caused, I was curious to see what other marketplaces see as "standard" amounts of earnest money. I set up a poll on LinkedIn under the National Association of Realtors® group, which I am an active member. In about 2.5 weeks, we received 295 votes on my poll. I stated that we had recently "offended" a buyer by asking for an increase in earnest money, and I was curious to know what the standard was in other areas of the country. I gave the following choices; Less than 1%, 1%, 2%, More than 2%. You can see the results of the votes below:

"Standard" Amount of Earnest Money Poll on LinkedIn:

To my surprise, the amount of 2% was the lowest vote, although the fact that the 1% amount was the highest vote did seem to be accurate. I was also surprised to see how many votes came in for the amount of More than 2%. The voting results was a fun and informative process and proves there is no actual standard, but it can be all over the board as far as what people see and what people expect to see.

The most informative part were some of the comments and discussions that were posted and shared along with the votes. Below are a few of the comments from other real estate agents across the country who posted to the online poll:

"I agree, that earnest money shows a buyer's commitment to a property. After all, the buyers are going to need to produce funds for downpayment at closing, so paying a partial amount upfront "shouldn't" be an issue. In a strong seller's market, like we have here in the Denver metro area, higher earnest money should separate the flakier buyers from the serious ones. I know of some buyers that offer more earnest money than the asking amount (which is specified in the MLS here) to show how serious they are. But generally 1-2% here, with some exceptions of course."

- Paulette Tupper CNE, SFR

"Here in GA a minimum on $1000 is required, and if the BUYER has cash up to $5000. Now that our inventory is low Buyers are willing to give the earnest money to show good faith and to win the battle of Hight and Best offer madness."

- Jacky Arias

"Chicago - Standard in the city is 10%, sometimes 5%. Suburban communities vary widely as to what is customary. Buyers will walk away from 1% without even thinking twice."

- Sara Benson, CRB, ABR

"Gosh! Here in Boston we require 5% for EMD. Seller's won't consider anything less. Maybe they were not that serious about the property or just did not have any additional cash on hand for the purchase process"

- Dara Alperen-Cipollone

"In Los Angeles 'normal and customary EM is 3% but in this brutal and competitive market with literally no inventory I have coaxed my buyers to writing 5% for earnest money. However, our contracts state 3% is the max a buyer could potentially "loose" if the deal went south so it is more of a good faith gesture. One of my buyers did not get the deal with over asking, 20% down and a 5% earnest money. BTW- my client's earnest money he was willing to deposit into escrow was $24,000.00:) The successful bidder paid a price higher than my client's offer and that winner offer even beat out a cash offer! Sonia, I agree serious buyers - serious EM deposit. However, it is challenging for some buyers to understand our current market conditions"

- Lori Donahoo

"Offended? Ridiculous! Sounds like their Realtor hasn't educated them properly. Here in N. Texas, $1000 is about minimum, and I often request at least 1% of the purchase price. It's refundable during the option/due diligence period, and gets credits to the buyer at closing, so what's the issue? There are also several buyer protections in the contract and financing doc, so the chance of a buyer losing the escrow deposit is pretty slim. Without some "skin in the game", buyers could terminate a contract much too easily. I am surprised that escrow is not required in some areas! With inventory so low, and multiple offers the norm, I encourage my buyers to make a minimum 1% escrow deposit as a show of good faith."

- Debra Chiarello

"Here in Atlanta, seems the standard was 1% (except sometimes intown); but now that we're in a seller's market 2% may become the norm. If I'm trying to help my buyers win a bidding war, a higher earnest money check helps!"

- Kirsten Conover

"1% is usual and customary in the Indy market. I make my buyers aware of that upfront along with what percentage places are typically selling for in the current market presuming they are priced appropriately. The only exception is if it's a first time home buyer where it's very clear via the offer that they are putting down minimum down payment and may not have the ability or the comfort level... never having done a deal before. If it's not a 1st time buyer then they should have had to deal with this issue before and in a counter as the seller's agent i will include the words... Earnest money to be Usual and Customary 1% of final purchase price to make sure the buyer knows we are not questioning their ability but rather just looking for the normal amount. On occasion if i have the buyer and the offer is particularly aggressive (or will probably be viewed that way by the seller) i encourage my buyer to increase the offer to 5 or 10K vs say the usual 1% on a 300K home to reassure a seller that my buyer is VERY serious about their offer vs just bottom feeding or testing the water. Earnest money is just like any other part of an offer and the old phase the greater the risk the greater the return should be evaluated. As a seller's agent lower earnest reflects greater risk and i would therefore hope to see greater return for the seller should they accept it. Conversely higher earnest dollars should lessen the risk of a deal going south and so would typically decrease the return on the seller's investment."

- Mitch Rolsky

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com