Park City Real Estate - Market Update

Posted by Sean Matyja on Saturday, October 29th, 2011 at 2:32pm.

Interested in Park City Real Estate? View our real estate market update for January - September of 2011. Below are informative statistics and illustrated charts for our Park City and Deer Valley real estate markets. We have seen our units sales continue to be strong, but pricing has seemed to be bouncing along the bottom. Some areas are still moving down in pricing, but some are actually moving up a little. There are many factors to these numbers, so if you are interested in a particular area, or community, you need to contact us and we can get you the detailed information. The good news is we are seeing good sales activity, and have been quite busy this fall, which is normally the slowest time of the year! Park City is a great place, and we still have many people who want to be here. Much of this information and charts has been provided by Rick Klein at Wells Fargo - (435) 647-9055. Give him a call for any financing needs!

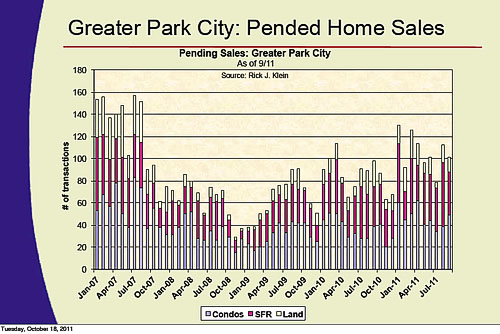

PENDING SALES

NATIONAL ASSOCIATION OF REALTORS®: Total housing inventory at the end of August fell 3.0 percent to 3.58 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, down from a 9.5-month supply in July.

GREATER PARK CITY: Total inventory as of October 1st August fell 5.0 percent to 1,682 condos, homes, and lots available for sale, which represents a 16.8-month supply based upon a three month average sales pace; however, this is down from a 21.5-month supply on October 1st 2010.

January thru September 2011 compared to:

2010 - up 19%

2009 - up 63%

2008 - up 52%

2007 - down 23%

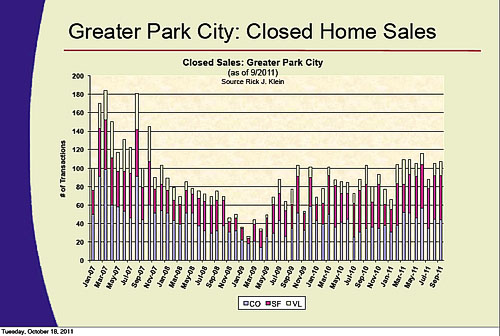

CLOSED SALES

NATIONAL ASSOCIATION OF REALTORS®: Total existing-home sales that include single-family, townhomes, condominiums and co-ops, rose 7.7 percent to a seasonally adjusted annual rate of 5.03 million in August from an upwardly revised 4.67 million in July, and are 18.6 percent higher than the 4.24 million unit level in August 2010.

GREATER PARK CITY: Total sales that include single-family, condominiums and vacant lots rose 19.3 percent to 105 units in August from a disappointing 88 in July; the increase was the same from August of 2010 with 88 units closed.

January thru September 2011 compared to:

2010 - up 18%

2009 - up 86%

2008 - up 30%

2007 - down 28%

CASH SALES

NATIONAL ASSOCIATION OF REALTORS®: All-cash sales accounted for 29 percent of transactions in August, unchanged from July; they were 28 percent in August 2010; investors account for the bulk of cash purchases.

GREATER PARK CITY: All-cash sales accounted for 45% of transactions in the third quarter, down from 48% in the 2nd

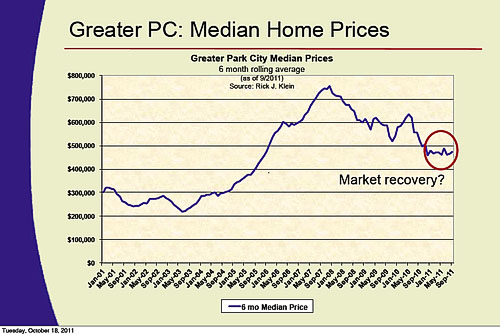

PRICING

GREATER PARK CITY: Our chart above shows what we have noticed this entire year. It has felt like we have been "bouncing along the bottom" for some time now. Looking at the stats, it shows what we have noticed. Whether or not we see pricing go up or down largely depends on what community or neighborhood you are looking at. Some have gone through a thorough inventory clean up. Others are still in the process. If you really want to know the status of your area of interest, give us a call and we'll go through the detailed numbers with you.

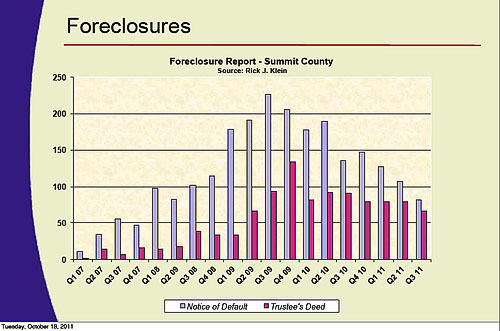

DISTRESSED PROPERTIES

NATIONAL ASSOCIATION OF REALTORS®: Distressed homes – foreclosures and short sales typically sold at deep discounts – accounted for 31 percent of sales in August, compared with 29 percent in July and 34 percent in August 2010.

GREATER PARK CITY: Distressed sales accounted for 27 percent of sales in the third quarter, the same as in the second quarter of 2011 and down from 36% in third quarter of 2010.

As you can see from the chart above, we are still dealing with foreclosure properties here in Park City, but we are seeing less of them. More importantly, the NOD's (Notice of Defaults) have come down quite a lot, so that may be a preview to seeing the foreclosures also coming down in this next year.

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com