Park City Real Estate Market | Pricing Trends from the Bottom of the Market back to the Top

Posted by Sean Matyja on Tuesday, February 12th, 2013 at 3:30pm.

The BIG Question is: "Have we passed the Bottom of the Real Estate Market?"

As Realtors in Park City, we get that question quite often. There is a lot of evidence that suggests that yes, it looks as though we have passed the bottom of the market. The next question to ask is: "Are we heading out of the bottom, and are we finally on our way back up?" So far, it does appear to be that way, but only time will truly tell. Just as when we were headed down to the bottom of the Park City real estate market, it was difficult to truly identify the bottom of the market until we were past it, and only then could we really measure and identify a true bottom of the real estate market in Park City, Utah.

If you follow our Park City Real Estate Blog then you will remember us realtors talking about being somewhere within the range of the bottom of the real estate market, which we call the buyer's "Sweet Spot". We borrow this term from golf. Golfers know that if they can precisley swing and connect their club to the ball in the sweet spot, it has a dramatic positive effect on their shot. Likewise in real estate, if a buyer can precisely time the purchase of a property within the buyer's market sweet spot, it can have a tremendous positive effect on thier investment potential.

According to the Quarterly Statistics Reports provided by the Park City Board of Realtors®, and according to what we see day in and day out in our market, we can say with confidence that we have passed the bottom of the market, but we do believe we are still within the Buyer's Market "Sweet Spot".

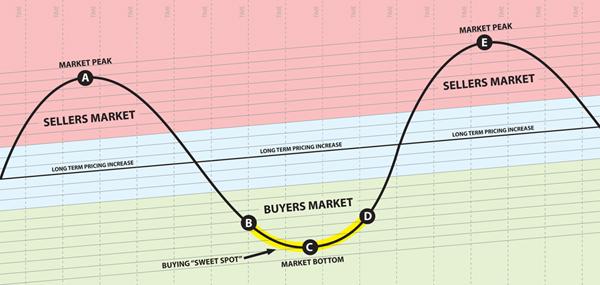

The chart above is a simplified visual illustration showing the trends of real estate pricing, from a peak in the market "A", down to the bottom of the market "C", and then back up to the next market peak "E". Looking at the chart above, we would say that for our current Park City Real Estate Market we are somewhere between point "C" and "D". Again, this chart simplifies the theory of pricing in the real estate market. Historically over the long term, pricing generally trends upward at a moderate pace, as you can see in the Long Term Pricing Increase line. Real Estate markets also historically have highs and lows, and therefore peak at times, then bottom out at times, as illustrated above.

For the Park City Real Estate Market, point "A" the peak of the market, occurred somewhere around 2007, depending on which neighborhood you are looking at. The bottom of the market, point "C", we have just witnessed mostly in 2011 and 2012, or possibly are still within (depending on which neighborhood you are looking at). So, it took 5 years to go from the peak to the bottom. Will it take 5 years to get back to the next peak? Who Knows? We think that after such a dramatic real estate downturn that it may take longer than five years to get back to another peak in pricing - but, only time will tell.

So, if we have passed the Bottom of Park City Real Estate Market, what does that mean to us now?

Well, if you are looking to purchase property in Park City Utah, the timing is actually quite favorable for you. Yes, you may have missed the absolute bottom of the real estate market, and yes you might pay a little more today than you would have paid a year ago. But lets look back to remember something. When we were at point "B" we knew, or thought we were close to the bottom, but could not prove it. So the buyers who had the foresight and the guts to buy at that point in time took a big risk. With that risk comes reward. They did not worry about trying to pinpoint the bottom exactly, point "C", or at least they did not let that worry affect their decision to make a purchase when they did. They knew they were so far along from the peak of the real estate market, point "A", and either at or very close to the bottom, point "C". The buyers who bought at point "B" took a calculated risk, and they deserve their reward.

The buyers who managed to buy at point "C" were largeley lucky, and owe gratitude to the group who bought at point "B". Hearing of the great buys that the group at point "B" were able to get, encouraged the group who bought at point "C". With a combination of smarts and luck, the people who bought at point "C" also took a calculated risk, buying with some level of uncertainty and they too deserve their reward.

Now that we have passed the bottom we are only slightly up from the bottom, and pricing is moving up slowly. So for anyone looking to buy, who may be disappointed that they missed the bottom, think again. The buyers who bought at point "B" had a lot of uncertainty at the time. Buying then was quite risky. Now at point "D" there is a real advantage in place. We now know that we are so far from the height of the market point "A", and we are safely pass the bottom of the market point "C" (hopefully). To be buying at point "D" can be considered an excellent investment move, and a fairly safe bet, especially compared to buying at point "B". If we truly are at point "D" and headed to point "E", which we think we are, there really is no better time to buy property in Park City.

Again, this is all in general theory of pricing and real estate market trends. To determine whether you want to buy, or should now buy a home or property in Park City or Deer Valley, allow us to talk with you, and together we can look over the detailed data of the particular neighborhoods you are interested in. As local Realtors specializing in Park City Utah, we can help educate you on the current real estate market trends. The chart above and this article simplifies the theory of real estate market peaks and bottoms. It is in doing research and due diligence of specific areas where we can truly help you determine if the timing is right for you.

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com