ATTENTION BUYERS: Did you miss the Market Bottom?

Posted by Sean Matyja on Tuesday, August 14th, 2012 at 3:23pm.

Trying to time the Bottom of the Market? Real Estate is a moving target. Its constantly changing annually, monthly, weekly, daily. Pricing goes up, and pricing goes down. With such a volatile market, such as what we have been in for a few years now, it is extremely difficult to determine when we hit the absolute bottom of the market. For Buyers, this is your goal. When is it time to score the best deal?

Well, for a few months now, as you'll recall if you have been reading our monthly newsletters, is that we have been saying we thought we were pretty much at the bottom of the market. Now we could not truly say with 100% certainty when we were at the bottom, (while we were in it) but we were quite certain on it, and we did try to let our clientele know of our market evaluation. The problem is after such a long downward trend, when we were finally comfortable with saying we thought we were at a measurable market bottom, most people did not believe us. Most people thought we still had more declining to go. But not everyone thought that way, and those of you who had the foresight to make a move a few months ago got some amazing buys.

The question coming up now is: "Did we miss the bottom?"

And our answer is: "Depends where you are looking, you just may have."

For many areas of town, the market bottom has come and gone. Meaning the amazing deals have largely come and gone. Now thats not to say you cannot find a great buy, but you do need to understand it is becoming much more difficult. And if you do find a good deal, you better move fast because there are many others out there looking for the same thing you are looking for. Most buyers still think they are one of the only few out there looking. The fact is, there are many out there. There are about 700 realtors just in Park City, Utah and each most likley has many prospects they're currently working with.

With such an increase in activity, and a clearing out of inventory (see our last 2nd Quarter Statistics Article), the prices are starting to bump back up in some areas, but then sometimes they'll slide back down again after a bump up. The inventory is drying up. There used to be many, many great homes on the market to consider. Now, once you narrow down your wants and needs, you end up with a small selection to choose from.

So where does that leave you. Did you really miss out? No, not really and here's why. 6-12 months ago, if you were looking, there was a tremendous amount of uncertainty in the market, and it was not the right time for many people to take the risk on buying. For those who did, those who took that risk, they will truly reap the reward of timing it just perfectly. Call it knowledge or luck, or most likely a mix of the two. For the rest of you considering a purchase, you are still well within what we call the "Buyers Sweet Spot".

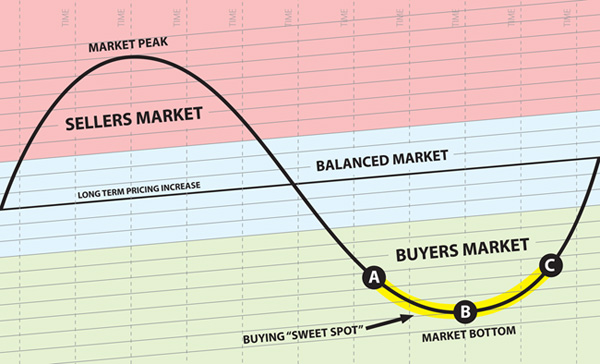

As you can see in the illustration above, there is a point of the market we call the "Buyers Sweet Spot" (as shown in the highlighted yellow). Rather than pinpointing a moment, this is a range of time, starting before the bottom of the market (A), then includes the absolute bottom of course (B), and then the time just after the bottom of the bottom (C). It is extremely difficult to pinpoint that absolute bottom (while in it), but you sure can identify when you have passed the bottom, which we have in many areas of Park City's real estate market.

If you remember, we wrote an article back in February 2012 describing how to recognize the Buyers Sweet Spot. At that time we talked about points A, B and C in the chart above and how to identify those points of the market. Again, here are the descriptions on how to identify these points.

Point A:

- Number of All Distressed Properties reaching new highs

- Prices declining steadily in all neighborhoods

- Activity now increasing strongly in some neighborhoods

With an abundance of Short Sales, Notice of Defaults (NOD's) and Foreclosures and Bank Owned / REO properties, pricing in all neighborhoods is driven down to new lows. Now that the pricing is finally down significantly, the leading buyers start coming back and they start buying, mostly cash deals. Once a few start, more follow and there might even be a buying frenzy in the areas that went into the downfall first.

***In our Park City Real Estate Market, we passed Point A a few months ago.

Point B:

- Distressed Properties - Number of NOD's decreasing

- Prices still declining in many neighborhoods, but starting to increase in others

- Activity now increasing strongly in most neighborhoods

The distressed properties continue, but less attention on Short Sales and more focus on the Bank Owned / REO properties where a quick cash deal can be made. Pricing is still declining in many neighborhoods, but in some they have reached their bottom. In fact in some it may be to late - the best deals have come and gone. For the overly cautious buyers who have been watching and waiting, they may have watched and waited too long, and missed the best opportunities. At this point the good properties that do come up go very fast. The NOD's have now been decreasing steadily, so at this point the market can expect to start also seeing a decrease in foreclosures. The inventory is shrinking, and the "junk" is getting cleared out, making way for new properties to bump pricing up finally.

***In our Park City Real Estate Market we have seen this in most neighborhoods. As of today, August 11th 2012, the data shows we have passed this point. Look at the signs, the bottom everyone was waiting for has come and gone, but don't worry, there's still time.

Point C:

- Distressed Properties - Number of NOD's down, foreclosures down

- Prices now increasing in most market areas

- Activity still steadily strong in most neighborhoods

Now that the NOD's are way down, the forecast for foreclosures is down and soon we'll see far less Bank Owned / REO properties. With the inventory shrinking, and cleaning up, sellers will feel like they can finally ask a little more again for the good properties. These good properties will eventually start selling again, at slightly higher prices, bringing the overall median and average sales prices back up, which in turn will allow sellers to ask a little more for the next properties, and so on, and so on. The buyers who have come to the party late will have to pay a bit more to get the property they want. But a little more is still better than a lot more, which is the direction the market is now headed.

***In our Park City Real Estate Market, this is where we are at. Depending on the area of town you are interested in, the market is nearing Point C or at Point C.

As of now, be warned, time is of the essence. For buyers who continue to wait, they will unfortunately find themselves priced right out of the market.

If you are considering buying, please reach out and talk to us. Let's have a real discussion. Explain to us your wants and needs. How often will you be here? What times of year? What is your comfortable price range, size range? Will you need financing? Is the ability to do nightly/vacation rentals important? What areas of town do you enjoy most? What is the size of your family? Any pets? Who will spend time at your home? What is most important to you? We really are a wealth of knowledge available to you. Take advantage of that. You will benefit greatly if you do.

Article from when we were approaching the bottom (February 2012):

http://www.enjoyparkcity.com/blog/recognizing-the-buyers-market-sweet-spot.html

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com