Park City Real Estate Statistics Report Year End 2015

Posted by Sean Matyja on Wednesday, January 27th, 2016 at 8:44am.

Park City, Utah – January 26th, 2016

Summit and Wasatch County property prices rise at a steady market pace in 2015

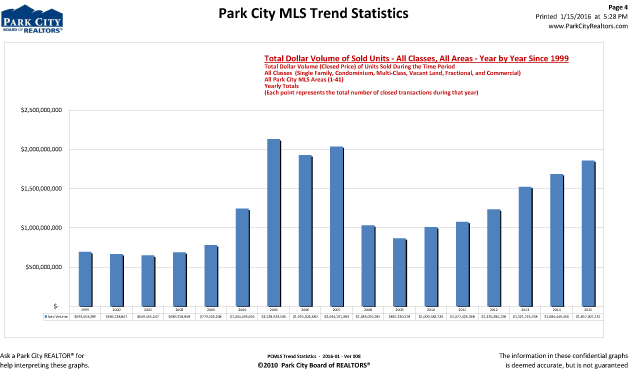

At the end of the fourth quarter of 2015, the year-end statistics reported by the Park City Board of REALTORS® indicated a slow but consistent annual increase in both the number of closed sales and the median sales price for single family homes, condominiums and vacant lots in Summit and Wasatch Counties. The total dollar volume for 2015 was up 10% over 2014, reaching $1.85 billion, with single family homes sales accounting for the highest dollar volume by property type.

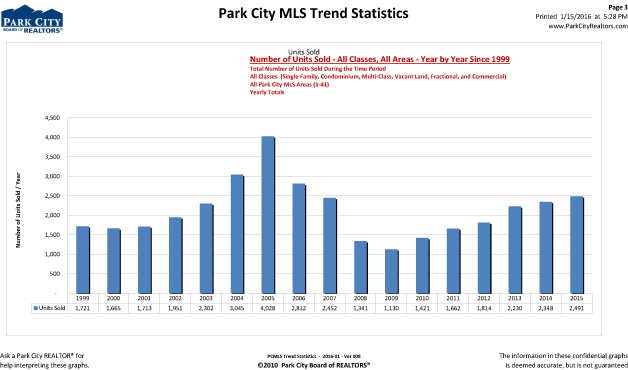

Above chart illustrates the Total Number of Units Sold by year from 1999 to 2015.

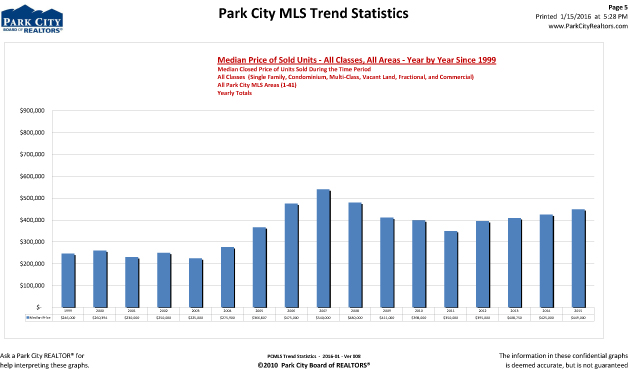

Above chart illustrates the Median Price of Sold Units by year from 1999 to 2015.

Above chart illustrates the Total Dollar Volume by year from 1999 to 2015.

Single Family Home Sales

Within the City Limits (84060), the median sales price of a single family home was 17% higher than the year before, reaching almost $1.52 million, but the number of closed sales decreased by 12%. By neighborhood, Old Town had the highest number of closed sales with a total of 52 with a 6% increase in median sales price to $1.31 million. Units sales for homes in Old Town saw a decrease of 10% in unit sales from 2014. Thaynes Canyon had the highest jump in median sales price – up 46% from 2014 to $1.82 million with a total of 11 closed sales for the year - basically due to a different level of price points selling in the neighborhood. Park Meadows had seven fewer sales than last year but the median sales price was up 11% to $1.44 million. In Prospector, the median sales price increased 6% to $740,000, but there were only 11 closed sales for the year (down 39%), which demonstrates how low inventory of active listings can affect the number of sales in certain neighborhoods. “Higher median prices of homes within City Limits and lower number of unit sales is reflective of demand outpacing inventory. In this case a decrease of home sales from the previous year is not a sign of a weakening market. In our current cycle, single family homes listed for less than the median sales price are in very short supply,” says the President of the Park City Board of REALTORS®.

Within the Snyderville Basin (84098), there were seven more home sales at year-end than 2014’s number, with an 18% jump in median sales price reaching $912,500. The median sales price shot up 23% in Jeremy Ranch to $874,000 and was up 25% in Silver Springs to $960,000, though both neighborhoods were slightly down in the number of sales - again largely due to the lack of available inventory. The highest increases in the number of sales occurred in Glenwild / Silver Creek (up 77% with 39 sales), Pinebrook (up 30% with 48 sales), and Jordanelle (up 85% with 37 sales). With new construction in Promontory, there continued to be an upward trend in the number of sales, ending the year at 60, with a median sales price of $1.67 million, as well as, in the Jordanelle area, with 37 total sales – up 85% from last year, and a median price of $900,000.

According to the Statistics Chair for the Park City Board of REALTORS®, “In and around the Jordanelle Reservoir we are seeing increased interest from both primary and secondary home buyers. There were 135 condo sales in Jordanelle at an affordable median price of $375,000, and 37 home sales at a median price of $900,000. Contrast that with the rest of Wasatch County ending the year with only 25 condo sales, but 241 single family home sales with an 8% increase in the median sales price to $369,000. We are definitely seeing a dual market then in Wasatch County, with the focus on the Jordanelle area for the newer condos.” In the Kamas Valley, there was a 10% increase in the number of sales with a 4% increase in median sales price to $310,500.

Condominium Sales

Within Park City Limits, the number of condominium sales was down 13% from 2014 but up 11% in median sales price reaching $605,000. Neighborhoods with increased closed sales include Lower Deer Valley Resort (up 25%), Upper Deer Valley Resort (up 23%), and Prospector (up 38%). The median sales price for a condo was up 9% in Lower Deer Valley to $780,000, down 35% in Upper Deer Valley to $995,000, down 24% in Park Meadows to $585,000, up 15% in Old Town to $450,000, and up 27% in Prospector to $155,000. “Once again we see the relative affordability in surprise sectors within Park City. The 55 condo sales in Prospector saw a remarkable $155,000 median sales price. Old Town and the base of Park City Mountain saw 108 condo sales at a median price of $449,000.” We expect to see some very large new numbers in 2016 for Old Town and especially in Upper Deer Valley as new construction projects like 820 Park Avenue and Stein Eriksen Residences begin to close their pending sales. We also are starting to see new condo developments beginning to launch sales, including One Empire Pass and Goldener Hirsch in Deer Valley and Apex and Lift at Canyons Village. These new levels of luxury product will further raise the numbers for both unit sales and median/average prices in the coming years.

The overall Snyderville Basin condo market was up 35% in the number of sales with a total of 361 sales, or one a day, at a median price of $400,000. The strongest condo market was at Kimball Junction and Jordanelle which each averaged a sale every two and a half days with 135 units sold at the median sales price of $375,000. The quantity of units sold in the Sun Peak/ Bear Hollow neighborhood was 71% higher in 2015 than 2014 with a median sales price of $394,000. Jeremy Ranch was up 36% in the number of sales and 15% in median price to $574,000. At the Canyons, the median sales price of $401,000 and 84 closed sales were both flat compared to last year’s number.

Vacant Land Sales

Vacant Land sales account for the smallest volume of the market by property type, though for the total market area, the quantity of lots sold was 9% higher than last year; median sales price was 13% up, and total dollar volume was 8% up. Within the City Limits, there were 13 fewer land sales than last year, a 33% decrease, but the median sales price was up a solid 18% reaching $677, 000. The median price for a lot in Park Meadows was up 19% to $970,000, and in Old Town it was up 35% to $575,000.

In the Snyderville Basin, there were 170 lots sold, which is the exact same number as 2014. The Glenwild / Silver Creek area saw increased activity with 42 units sold and a 19% median sales price increase to $443,000. The two neighborhoods with the highest number of vacant land sales were Promontory up 31% to last year with a total of 72 units sold and a median sales price of $305,000, and Jordanelle up 92% with a total of 69 lots sales and a median price of $250,000. Though the number of sold lots dipped slightly in both the Heber and Kamas Valleys, the median sales price increased 15% in both areas reaching $205,000 in Heber and $101,000 in Kamas.

Looking Ahead

The gradual increase in dollar volume, median sales price, and number of closed sales in Summit and Wasatch Counties indicated strong and steady growth in 2015, though the market in general is not back to the highs of 2007 - although some market segments are seeing new levels of pricing surpassing the numbers we saw back at the last height. The median sales price continued to rise at a pace of 4.7% this year, which fits the upward trend we have been seeing annually since 2011. There is still affordable property to be found within Park City Limits and the Snyderville Basin. While new construction continues to be in high demand, buyers must pay the premium costs for it.

“Over the past five years, our market has continued to post solid gains. Changes in the overall market have been steady and for the most part, headed in the right direction. Demand appears to be increasing and as more buyers focus on our area for family, work, retirement and lifestyle, inventory will be an issue, particularly in popular areas. Our community will continue to grow and with that, we hope there will be a variety of housing opportunities for a wide range of buyers,” says the Board President. Our market continues to be highly segmented with micro-markets dividing product by price, property type, and demand, so it is best to contact a local Park City REALTOR® for information on what is happening in your neighborhood.

We love looking at these statistical numbers to help in evaluating the market trends, but the real info is when we dive deep into a particular neighborhood and determine what really is going on. If you are planning to buy or sell, have us run a detailed report for your neighborhood and we'll help you to decipher the info and how it relates to the trends we are seeing in your area as it relates to the general Park City real estate market.

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com