2017 Quarter One Real Estate Statistics for Park City

Posted by Sean Matyja on Wednesday, May 17th, 2017 at 7:28am.

The Park City Board of Realtors produces quarterly statistics reports comprised of all sales data from the PCMLS. Below is the report for Quarter One of 2017.

Demand for real estate in Summit and Wasatch Counties leads to a record-breaking first quarter of 2017

The number of closed sales for the first quarter of 2017 in Summit and Wasatch Counties was the highest we’ve seen since 2007 – up 20% over 2016, according to statistics released by the Park City Board of REALTORS®. Q1 also saw the highest number of pended sales on record and a 26% increase over the previous year in total dollar volume. Growth continued to morph, and expand, encompassing outlying communities in the Wasatch Back as the entire market area was pushed to new peak levels.

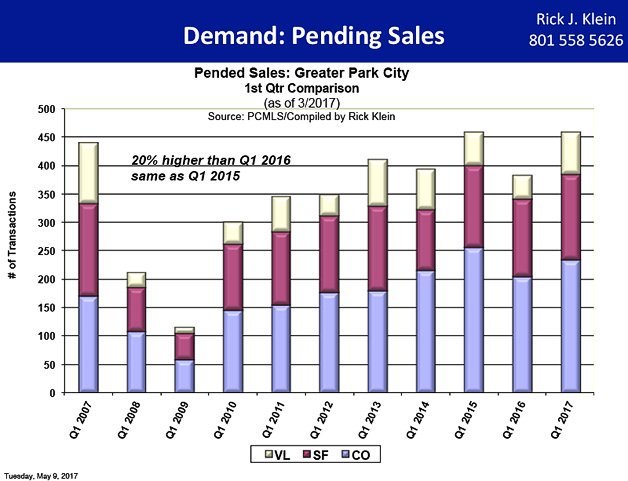

Nationally, NAR stated (4/21/2017) existing home sales skyrocketed in March to their highest level in 10 years. Sales increased 4.4% over February to a SAAR of 5.7M. This is 5.9% higher than one year ago. Dr Yun said “although finding available properties to buy continues to be a strenuous task for many buyers, there was enough of a monthly increase in listings in March for sales to muster a strong gain. Sales will go up as long as inventory does.” The GPC three month rolling average is the same as last month, but is 25% higher than March of 2016. For pended sales in 2017, the Park City market saw a Q1 that was 20% higher than Q1 in 2016. March in particular was very impressive with the highest pended numbers since 2006.

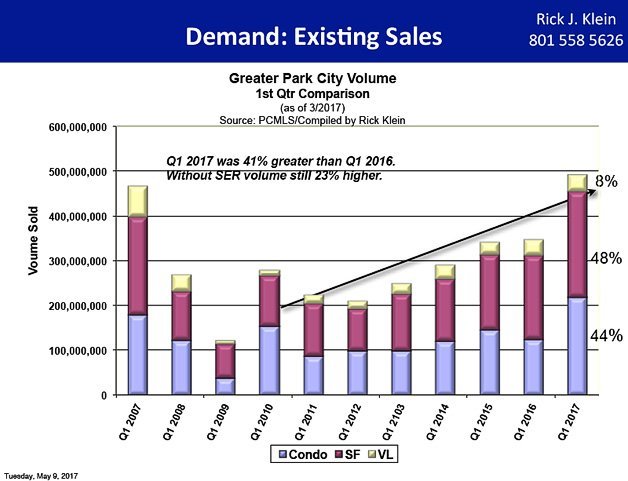

The total dollar volume for the Park City Board of Realtors has shot way up with Q1 2017 up by 41% over Q1 of 2016. Much of the sales volume can be attributed to the success of the closing from Stein Eriksen Residences in Upper Deer Valley. Even if we take out SER, the increase would still have been about 23% higher. We continue to see an increase in pricing on existing product, but also our market has been evolving with new luxury product and a higher level of construction, finishes and features being introduced to ur community. Yes prices are moving up, but also, the level of the product is moving up.

Looking at available inventory, the market held a consistent pace for the last three years. May 1st of 2017 showed 1,123 listings as compared to 1,078 listings in May of 2016. The supply remains limited, and Buyers are experiencing difficulty finding the right fit, at the price they have in mind. The absorption rate has increased slightly from a rate of 6.4 months to 7.5 months. This could be due to buyers in the market having trouble finding a property that meets their needs, and possibly looking longer, as a result of the higher prices they encounter. There is a dramatic difference in absorption from the lower end product that often sells quickly, to the higher end that tends to sit on the market four to five times longer. In town, a single family home under $1,850,000 has an absorption rate of 4 months. Over $1,850,000 it increases to 18 months. Condos under $705,000 see absorption at 3.6 months, but over that price the rate increases to 14 months.

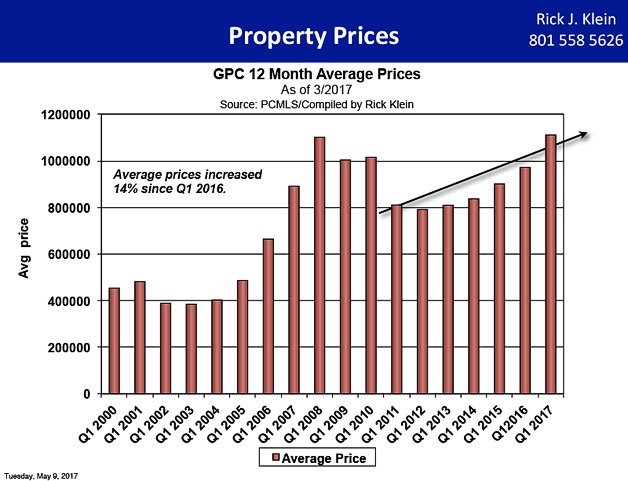

Prices have now increased on average by 14% for Q1 of 2017 compared to Q1 of 2016. Even if we pull out all the high-priced sales at Stein Eriksen Residences, we would still see an increase of about 8.4%. The median price was up by 13%. With the higher prices in the market, buyers need to recognize the need to move up in price if they have been looking for over a year or more. For sellers, we are seeing a very opportune time to sell in our Park City market.

Single Family Homes

Micro-markets developed and shifted as low inventory affected the activity in certain neighborhoods. The median price surged upward where the supply was limited, and conversely, the number of sales surged upward where a moderate supply could be found. Broken down by area, the median price and number of units sold varied:

Park City Proper (84060) – Limited supply resulted in only slight growth overall in the number of units sold but there was a 21% median price increase reaching $1.85M for single family homes within the City Limits. Lower Deer Valley, with 17 more home sales than the previous twelve months and a median price of $2.13M, was a hot spot of activity. Still highly sought after, Park Meadows had seven fewer sales but saw an 18% price increase reaching $1.75M.

Snyderville Basin (84098) – With moderate supply in the Basin, there were 45 more home sales than the previous 12 months – up 13%, accompanied by a price increase of 7% to $972,000. Certain neighborhoods, like Summit Park, had 28% more closed sales and a 9% median price increase to $600,000. The popular neighborhood of Silver Springs, where inventory has been consistently low, saw ten fewer closed transactions than the same time last year, with a slight dip in median price to $910,000. In the Basin, Promontory had the highest number of transactions with 67 closed sales and median price of $2M, indicating that new product and amenities remained in high demand.

“We have been seeing buyers who may start looking in Park Meadows or Deer Valley, then end up preferring the amenities offered in our Gated Communities. Buyers are also willing to pay a premium for new product,” says the President of the Park City Board of REALTORS®.

Jordanelle – Offering new construction but a limited supply, the Jordanelle saw little growth in number of sold units, but a giant 64% leap in median price reaching $1.49M.

Heber Valley – Becoming increasingly popular with buyers for the bang for the buck and offering a moderate supply of inventory, the Heber Valley had a very active twelve months. With new product on the market, there were 98 more home sales – up 37% from last year, but the median price held in check to last year’s number of $397,000.

Condominiums

Within the Greater Park City Area, the condominium sales accounted for almost half the number of closed transactions in the first quarter. The number of condo sales in Old Town and Jordanelle exceeded any other area. There were 134 units sold in the last twelve months in Old Town – 34 more transactions than the previous year. The median price in Old Town also shot up 31% to $583,000. In the Jordanelle area, there were 190 condo sales over the last 12 months and a 30% price increase to $485,000. Canyons had the highest number of condo sales in the Basin, with 116 and median price climbed to $675,000. There was also a spike in the number of units sold in Pinebrook with a total of 70 with a 9% median price increas to $458,000.

“The fast paced activity in the Jordanelle condo market attests to that fact that growth continues to be oriented in that direction. Outlying areas are being perceived as simply an extension of Park City and an evolution of the larger market picture,” said Valuation Consulting Group.

Vacant Land

Vacant land did not show much growth in either sale numbers or values, but with limited supply of existing product coupled with strong demand, it may be only a matter of time before the land market awakens more fully and movement occurs.

Looking Forward

The PCBOR President concluded, “It feels like Summit and Wasatch Counties are entering a boom time. With the number of first quarter closed and pended sales at some of the highest we have seen to date, our market area has reached pre-recession levels. Buyers are willing to travel further distances if they can find value, pushing the number of closed sales up outside the City Limits. Distance from front door to ski chair doesn’t seem to be quite as much as a factor for current home buyers. What used to be perceived as “far away” or “out of town” is not so anymore.”

Other notable thoughts - Demand has been relatively consistent but with signs of it actually increasing. This varies considerably per area; for example the sale of homes in areas "in-town" are only up 2.5% while homes in the basin are up 12%. Supply is relatively consistent and up 3% over last year. This varies considerably as well where Old Town condos are up 26% while SF is down 17%. Overall, price appreciation is remarkable with median prices up 14%. Median price is rising in all areas with median SF in town rising over 20%, which we can predict as not sustainable. At Canyons Village, the question is will new projects create an oversupply? So far, the pace of new product has been matched by the demand of buyers.

Due to the uniqueness of our market area and the varying degree property types, neighborhood characteristics, and inventory levels, buyers and sellers are encouraged to contact a local Park City Board of REALTORS® Professional Agent to find out more detailed housing information. For further information, contact the Park City Board of REALTORS®

Sean Matyja - Realtor® / Associate Broker

Mobile: (435) 901-2158 | Email: sean@enjoyparkcity.com